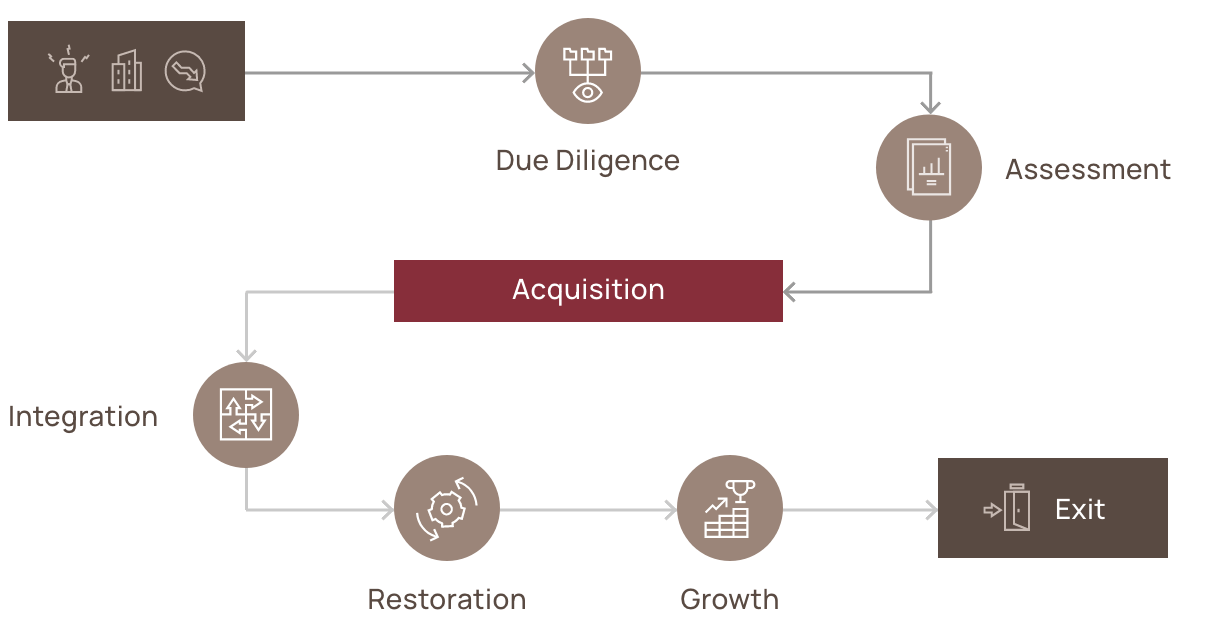

Methodology

Our Methodology has been developed to effectively evaluate and enhance companies, struggling to reduce expenses, expand the pipeline, and accelerate both revenue and profitability.

Relationships

Our team has very close relationships with leaders across the Enterprise Software market.

Uncover Deals

Underperforming companies in the lower-mid market are turned around quickly based on the background/ network/expertise of the team, consistent with our Methodology.

Review

Lotus reviews both on/off market deals when evaluating what to invest in and how to build the overall fund investment strategy.

Due Diligence

Lotus evaluates all aspects of the company, with particular focus on pipeline, technology, and back office efficiency.

Hands-on Approach

As former Operators, Lotus has real-world experience in identifying issues, understanding best practices, and how best to accelerate PC performance, more effectively than other PEs.

Execution

As a Buyout fund, Lotus is an active, hands-on manager, focused on the implementation of best practices, resulting in an accelerated time to value for both PCs and investors.

Exit

Lotus has considerable experience positioning a PC for exit. As PC performance improves, our team engages in regular conversations with potential Strategic/Financial investors.

STAGES